Setting Up In India Can Alleviate An EU Energy Crunch As Cheap Energy Fuels Productivity And GDP Growth

The Ukraine conflict is having the effect of significantly boosting Russia’s trade with numerous nations, as the world’s largest energy player goes in search of new markets in the wake of energy sanctions being imposed by the West.

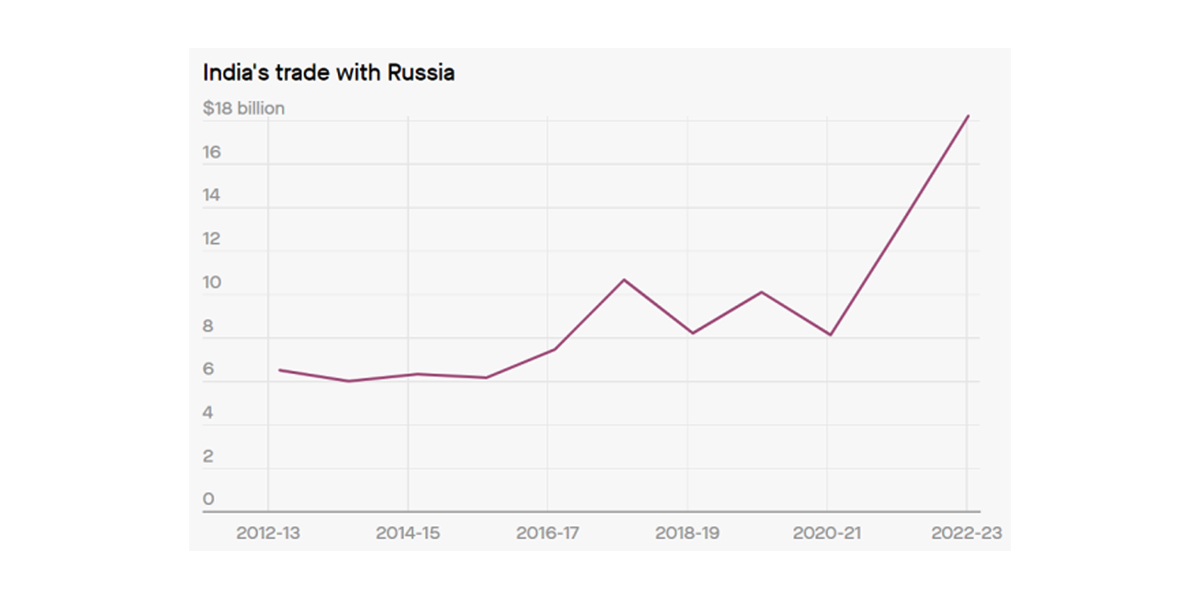

Trade with India, which Russian President Putin and Indian Prime Minister Modi had been previously set as a target of US$30 billion to be achieved by 2025, is set to be well over that, three times earlier than planned.

India’s bilateral trade with Russia has risen to a record high of US$18.2 billion between April and August, according to India’s Commerce and Industry Ministry. Compounded, that indicates a 12 monthly level of US$43.2 billion. This has been fuelled by a surge in the import of oil and fertilizers.

Source: Indian Ministry of Commerce & Industry

Source: Indian Ministry of Commerce & Industry

When the conflict with Ukraine broke out in February, many nations, including India, scrambled to find trade alternatives for commodities Russia exported. Moscow then provided discounts, to motivate energy production and supplies to alternative energy markets. India’s energy needs for example, according to the Central Electricity Authority (CEA), an advisory body to India’s Federal Power Ministry, have said that India’s power demand would reach 1,874 billion units by March 2027, compared with 1,320 billion units in the fiscal year ending March 2022.

Moscow offered discounts on Russian crude and fertilizers to ensure India maintained trade and illustrate to New Delhi that it could satisfy India’s growing needs. As a result, Russia is now India’s seventh-biggest trading partner.

India’s imports from Russia have typically included petroleum oil and other fuel items, and fertilizers, mixed in with consumables such as coffee and tea, spices, and animal and vegetable fats. As at now, fertilizers and fuel alone accounted for over 91% of bilateral trade in 2022. In September, Russia became India’s second-largest crude oil supplier.

However, despite the current onus on oil and fertilizers, Russia will still need to be competitive. New Delhi is not a client state because it is pro-Russia or anti-West. It is purely a matter of economic reality. India will probably continue to import more Russian crude during late 2022 as refiners ramp up production to meet the seasonal rise in domestic demand and higher export demand from Europe, as the Northern Indian and European winters set in. Temperatures in Delhi can drop to single digits during December-February and lower in the Himalayas.

That said, the Indian economy is currently growing at just over 4%, when EU economies are heading into recession. That, and cheaper energy supplies suggests that European manufacturing industries will start to invest in India to produce for European markets, and further provoke increasing Indian energy demands. Russia will be looking to supply that need.

However, despite the concentration of Indian trade with Russia being energy focused, there are opportunities elsewhere. Non-energy products are starting to make inroads into Russia, both in terms of replacing Western products, but also as Russia has legalized parallel imports. While the West has barred Russia from receiving imported luxury brands for example, countries such as India are developing a middle-man route and savvy entrepreneurs and dealers are buying Western goods and reselling them to Russian consumers. These include everything from air-conditioner units and iphones to Bentley automobiles. An example of this trade is seen when the new Apple iphone 14, launched post-sanctions, was on offer a week after the official launch on Russian online stores. The volumes are high enough from the Russian market to mean Russian consumers pay just a 10-15% premium on what the Russian retail price would have been under normal circumstances. Western, and especially EU manufacturing industries will, during the course of 2023 onwards, be looking to set up manufacturing plants in India to take advantage of India’s lower energy costs, to supply their domestic demand – and to supply the Russian market they have been exiting.

This article originally appeared in www.russia-briefing.com , October 23, 2022 . Original link.