By Engineer Arshad H Abbasi

Pakistan’s power sector is a leaking bucket: the holes deliberately crafted, and the leaks carefully collected as economic rents by various stakeholders who control the system. It is a self-evident truth that our power sector is bedevilled by corruption, greed, inefficiency, and injustice. While this is so, the bills have continued to increase. The main hole in the power sector bucket is circular debt, aside from expensive electricity.

In Pakistan’s power sector, circular debt is a public debt that builds up on distribution companies as a result of unpaid government subsidies. When this occurs, the country’s debt is exacerbated because the distribution companies are unable to pay IPPs and CPEP Power Plants, who in turn are unable to pay fuel suppliers. Pakistan’s total circular debt as of March 2024 was Rs. 3,000 billion.

Pakistan is in the midst of political and economic turmoil, with record inflation primarily due to the high cost of electricity to the extent that it is now challenging national sovereignty and has posted the lowest GDP since the country’s creation. The majority of Pakistanis pay bills that are far higher than their monthly income, which is the worst of all. The cost hike is all because of circular debt in the power sector.

Moving from cheap hydroelectricity to imported oil, coal, and LNG-fired power plants is the fundamental cause of the circular debt and the enormous price increase for electricity. While expensive electricity generation has put a severe strain on the nation’s finances, it is now challenging national sovereignty. The extraordinary unrest, protests, and dissent caused by electricity in Azad Kashmir during the second week of May shocked Islamabad and served as a sobering reminder that the electricity sector poses the greatest threat to national security.

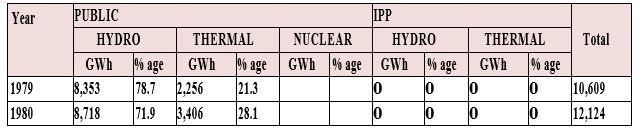

Hydropower was once a major source of energy in Pakistan, accounting for nearly 60% or more of all electricity generation until 1991. However, this share has dropped to about 29% due to a decline in the construction of hydropower plants and rising demand. The share of thermal generation has risen to about 50%, with most plants using unaffordable oil, LNG, imported coal, or gas.

Pakistan was put off track in the late nineties from hydroelectricity to thermal power electricity generation when the construction of the 3600-megawatt Kalabagh Dam on the Indus River could not be started because of political controversies. The dam was due to be completed in 1993.

Pakistan’s transition from hydroelectricity to thermal power generation was derailed in the late 1990s when political disputes prevented the construction of the 3600-megawatt Kalabagh Dam on the Indus River, which was scheduled to be finished in 1993. A small group of sycophantic and pseudo-environmentalists have skillfully crafted political controversies that seriously undermine the harmony between Pakistan’s four provinces too. In 2004, the then Federal Minister for Parliamentary Affairs issued a press release that Independent Power Producers (IPPs) operating in the country were behind the anti-Kalabagh Dam move because they did not want to see Pakistan meeting its energy requirements through its indigenous resources.

The annual production of clean electricity would have been 11,400 GWh (million units) if the Kalabagh Dam had been completed in 1993. Yet, because of political controversies, the dam could not come up on schedule. This failure to develop the Kalabagh Dam has resulted in a severe electricity shortage. The installed capacity in the country was 10,800 MW with a shortage of around 2000 MW in 1993. This capacity was insufficient to meet the demand, so consumers had to be subjected to load shedding (forced power cuts). The then PPP government came up with the 1994 Power Policy designed for thermal power plants. The government offered very generous and lucrative incentives to investors without considering rational tariffs according to EPC (Engineering Procurement Cost) construction.

The policy made a tariff of 6.5 cents per KWh appealing to potential investors. The average cost of producing hydroelectricity was only two cents per KWh. Nevertheless, Pakistan saw remarkable economic growth between the early 1960s and the early 1990s, when hydroelectricity accounted for the majority of the electricity produced. At the same time, the price of electricity was not only affordable for consumers, but it also did not put a strain on foreign reserves or require monthly fuel adjustments. Most importantly, Pakistan had zero circular debt during that golden period when hydroelectricity was ruling the energy mix.

Burning 92 billion cubic feet of petrol annually to generate electricity instead of using water as fuel was one of the major losses incurred by the nation as a result of the Kalabagh Dam’s incompleteness. The valuable 2760 billion cubic feet of natural gas needed to turn plant turbines has been depleted by this disastrous switch from hydroelectricity to thermal power generation. If the Kalabagh Dam had been generating hydroelectricity at the same time, USD 3.5 billion in LNG imports per year could have been avoided, and the country would have had enough gas for industry and domestic use until 2050.

Executive Summary

The 1994 Power Policy was designed to attract foreign investment with a high tariff rate. The IPPs were allowed to use any technology and were free to choose any main fuel. According to the Power Purchase Agreement made by the purchaser WAPDA with the IPPs, the tariff is computed using a formula that includes components of fixed and variable costs. The total tariff is the sum of the Capacity Purchase Price (CPP), which is the fixed component, and the Energy Purchase Price (EPP), which is the variable cost. The fuel price was deemed to be a pass-through item. The induction of IPPs initiated the circular debt issue. Besides passing the burden to 35 million consumers, circular debt has made Pakistan a global begging bowl.

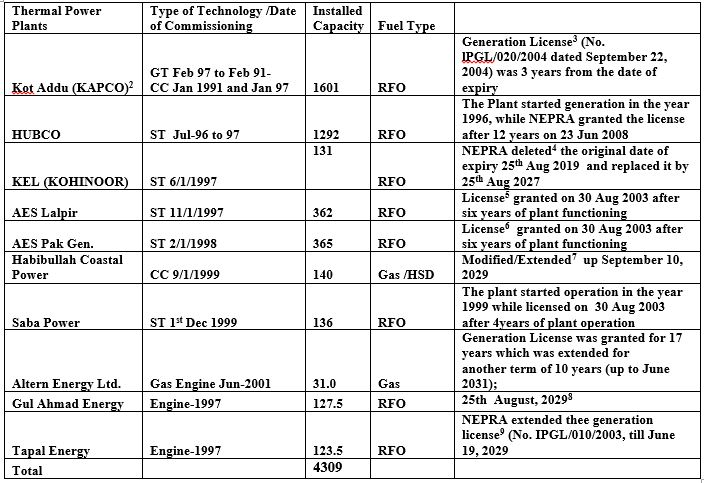

As indicated in Table 2, there are 15 IPPs that were commissioned per the 1994 power policy. As of April 2024, 74 thermal power plants across the nation are operational, following various policy changes. These IPPs, including CPEC energy projects, have grappled with persistent issues in the electricity sector, ranging from increasing capacity payments and over-reliance on imported fuel to under-utilization of power plants, circular debt, transmission constraints, operational inefficiencies, and under-utilization of HVDC lines. However, the primary driver of the electricity sector’s stress is poor governance, spanning from planning to execution and subsequent operation, coupled with a severe lack of accountability.

Circular Debt

The responsibility for purchasing electricity on behalf of EXWAPDA DISCOs is currently handled by CPPA-G, replacing WAPDA. Via the transmission company, NTDC, CPPA-G buys electricity from generation companies to supply to DISCOs. Furthermore, KE also receives electricity from CPPA-G. When electricity is supplied, CPPA-G bills all distribution companies for the power supply as well as for the transmission company’s use of system charges. To enable CPPA-G to pay the generation and transmission companies, distribution companies must pay CPPA-G the outstanding amount within the allotted time.

However, the majority of distribution companies are unable to make payments on time due to a variety of factors, including higher T&D losses, lower recoveries, etc., which makes it more difficult for CPPA-G to pay the generation and transmission companies. Consequently, when generation companies are unable to reimburse fuel suppliers who are experiencing difficulties paying the import bill, circular debt is created. This situation perpetuates the cycle. Under PPAs, there is a markup and a higher financial liability if power companies are not paid on time.

High Cost of Generation Due to Capacity Payment

Without analyzing consumption, a significant amount of generation capacity has been added in recent years. The cost of electricity for end-users has risen for a variety of reasons, including high T&D losses, low recovery, circular debt, large capacity payments, currency devaluation, fuel costs, and underutilization of efficient power plants. For example, when the installed capacity was 34,848 MW, consumption was 130,000 million units, while when the installed capacity reached 41,198 MW, generation decreased to 129,485 million units. This means that after the addition of 6000 MW, it is generating a negligible increase in units, mainly contributing to capacity payments without operating the thermal plants. Though there are other factors such as increasing fuel costs, rupee devaluation, reduced electricity usage, and negative sales growth, the main reasons are circular debt and abnormally high capacity payments. The total tariff is the sum of the Capacity Purchase Price (CPP), which is the fixed component, and the Energy Purchase Price (EPP), which is the variable cost.

While analyzing the availability factor of gas/RLNG power plants (which is 92%), coal power plants (which is 85%), and RFO power plants (which is 88%), the optimal utilization of the most efficient power plants is opted to minimize the cost of power generation in the country. It is observed from the data that the efficient power plants are either not utilized or under-utilized while dispatching to power plants with lesser efficiency, which causes an increase in the per unit electricity cost for end-consumers. Underutilizing the efficient power plants not only deprives the country of available cheaper electricity units but also increases the burden in the form of capacity payments for unutilized capacity. Departure to the less efficient plants causes inefficient burning of fuel, translating into expensive electricity for consumers.

The major issues causing the high cost of electricity, other than inflated contracts with IPPs, are deliberate non-use or underutilization of the optimal operation of the most efficient power plants. The use of highly inefficient power plants, particularly by K-Electric in Karachi, exacerbates the situation. Non-use or underutilizing the efficient power plants not only deprives the motherland of available cheaper electricity units but also increases the burden on the national economy in the form of capacity payments for unutilized capacity.

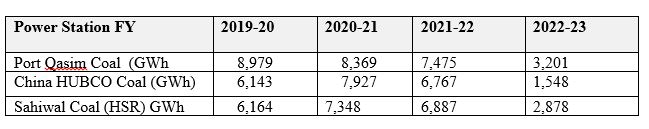

The reason for the continuous rise of circular debt is the operation of inefficient power plants. The glaring examples of non-usage of efficient power plants and capacity payments are 1250 MW HUBCO Coal, 1250 MW Sahiwal Coal (HSR), and 1250 MW Port Qasim Coal power plants. Particularly, 1250 MW HUBCO Coal and 1250 MW Port Qasim fall within the jurisdiction but have almost remained idle for the last two years. Yet, at the same time, both IPPs claimed capacity charges at 60%.

Capacity Payment is the result of ‘Take or Pay’ and ‘Take and Pay’ Contracts

The majority of PPAs involving base load thermal power plants are “Take or Pay” agreements that are based on capacity and mandate capacity payments against available generation capacity whether or not it is used. The ‘Take or Pay’ mandate demands that these power plants be used to their fullest potential to prevent needless capacity payments, which increase the cost of each unit of electricity produced.

While successive governments concentrated on building more power plants, the maximum utilization of these facilities has frequently remained unattainable, resulting in higher electricity prices for consumers and a significant financial burden for the power sector regardless of the sale of electricity.

The base load “Take or Pay” for CPEC and other major thermal power plants in the CPPA-G system dropped from FY 2019–20 to FY 22–23, meaning that customers were also required to pay capacity charges for 60% of the unutilized capacity. Below is the table showing how the electricity generation from three major CPEC power plants dropped in FY 2019–20 and FY 22–23. This means a huge addition of capacity payment was added to the circular debt.

Retirement of Inefficient Public/Private Sector Generation Plants

In this report, one of the key factors adding to capacity payments is the retirement of inefficient public/private sector generation plants, which is completely missing from government policy and national power regulator considerations. To simplify understanding, as people retire, power plants also retire. Old power plants have maintenance, efficiency, and technology issues. Typically, old power plants suffer from low efficiency and higher O&M costs, while new plants would have higher efficiency and lower fuel costs.

Globally, particularly in India, thermal power plants have an average service life of at least 20 years, but they are usually designed for continuous operation of more than 25 years. According to the Indian Electricity Authority, any thermal power plant completed 25 years may be retired. Following this policy, from March 2016 to May 2019, thermal power units totalling 8470 MW capacity, which were 25 years or older and inefficient, were retired due to uneconomic operation or low efficiency.

It is noted that there does not exist any clear policy regarding the retirement of thermal power plants in place. However, the regulator NEPRA can play a pivotal role in the development and implementation of such policies which take into account the efficiency of the plant, economic, and environmental considerations.

The Paris Agreement requires that each Party to the UNFCCC prepare, update, and communicate its Nationally Determined Contribution (NDC) document, declaring the actions it plans to undertake to combat climate change, especially to reduce its greenhouse gas emissions from thermal power plants. Accordingly, Pakistan set a cumulative ambitious conditional target of an overall 50% reduction of its projected emissions by 2030.

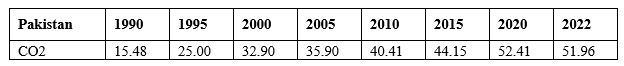

It is a scientific fact that over 40% of energy-related carbon dioxide (CO2) emissions are due to the burning of fossil fuels for electricity generation. The Government of Pakistan, after the floods of 2022, is globally beating the drum that the country is one of the most affected countries by adverse impacts of climate change as well as air pollution. Yet, the ministry and NEPRA both never bother to check that the power sector in Pakistan is one of the major contributors to GHG emissions in the country. The national electricity mix is dominated by thermal power projects emitting large quantities of CO2. This is shown in the graph.

The National Power System Expansion Plan (2011–2030) calls for the retirement of a sizeable portion of current thermal power plants—6,935 MW—by NTDC, the party that signs power purchase agreements with IPPs. According to this plan from NTDC, a company that used to purchase electricity from IPPs, 127.5 MW of Gull Ahmad Energy and 123.5 MW of Tapal were scheduled to retire in 2019–20. However, NEPRA also approved a ten-year license extension for them. One of the primary causes of the endless cycle of debt that is currently causing instability in Pakistan is the horrible crime committed by NEPRA, which was to grant generation licenses to outdated and inefficient plants. The nation would have avoided financial catastrophe if NEPRA had not decided to extend their generation.

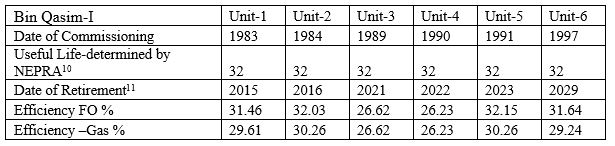

All GENCO power plants, except the 545 MW Nandipur Thermal Power Plant and the 747 MW Guddu Thermal Power Plant, have a combined installed capacity of 2,435 MW and ought to be retired based on their old commission date.

Conclusions and Way Forward

Over time, the efficiency of outdated thermal power plants has declined. Additionally, as a result of their low efficiency, the plant utilization factors have decreased to lower bounds. The nation is constantly burdened by the operation of inefficient GENCO and IPP power plants. It would be financially disastrous to keep operating the outdated, inefficient steam thermal power plants when there are plenty of capable, efficient power plants available on a “take or pay” basis. While NEPRA has consistently stressed the need to only retire the GENCOs’ older power plants, it has never mentioned the retirement of IPPS’s thermal plants, which would have lessened the sector’s financial burden and diverted precious fuel to the most efficient power plants.

It is strongly advised that all of the aforementioned thermal power plants shut down right away to stop the circular debt and lower consumer electricity bills. This GOP action will adhere to international agreements, particularly to respect the Paris Declaration, which committed Pakistan to lowering its carbon footprint. It is important to remember that power plants emit more carbon dioxide when they operate less efficiently, even though they are producing the same amount of electricity.

If the UN does not take up the recommendations for their appropriate operationalization, there’s little chance that a government facing serious institutional collapse will be able to swiftly address these vexing challenges.

- Power System Statistics- PLANNING POWER NTDC

- NEPRA!RJLAG-18-September 08, 2022

- No. NEPRA/R/LAG-17/0 dated October 15, 2014

- NEPRA /LAG 7737 -38

- NEPRA /LAG 7739-40

- NEPRAIRILAG- 13/ J I dated November 05, 2020- License Application No. LAG-13

- NEPRA/R/LAG-10/ 90 -March 19, 2020-Modification-I in Generation Licence No. IPGL/09/2003

- NEPRA/R/LAG-11/ 77-‘29 –dated March 09, 2020

- Detail of Generation Facility/ Plant-I by NEPRA GENERATION LICENCE No. GL/04/2002

- Modification-IV in Generation License No. GL/04/2002 KESC No. NEPRA/R/LAG-05 /0 77 August 22, 2013