The deepening Sino-Saudi economic connections are evident in the remarkable surge in their trade volumes. Starting at $4.1 billion in 2001, the bilateral trade skyrocketed to a staggering $87 billion in 2021, marking a quadruple increase. This noteworthy growth becomes even more intriguing when contrasted with Saudi Arabia’s combined trade volume with Western countries and the US, which amounted to $38.8 billion in 2001 and reached $78.2 billion in 2021. The Sino-Saudi strategic partnership is an inspiring example for Pakistan to convert its social capital potential into economic growth and regional connectivity through geo-economics. Pakistan can also benefit from the Sino-Saudi partnership by investing in its human capital development sector; setting up universities and strengthening institutions, as a prerequisite to attracting Foreign Direct Investment (FDI). Pakistan can position itself to leverage opportunities if it plays its cards well. But unfortunately, no one is home to lead Pakistan out of the current crisis due to lack of leadership by all stakeholders.

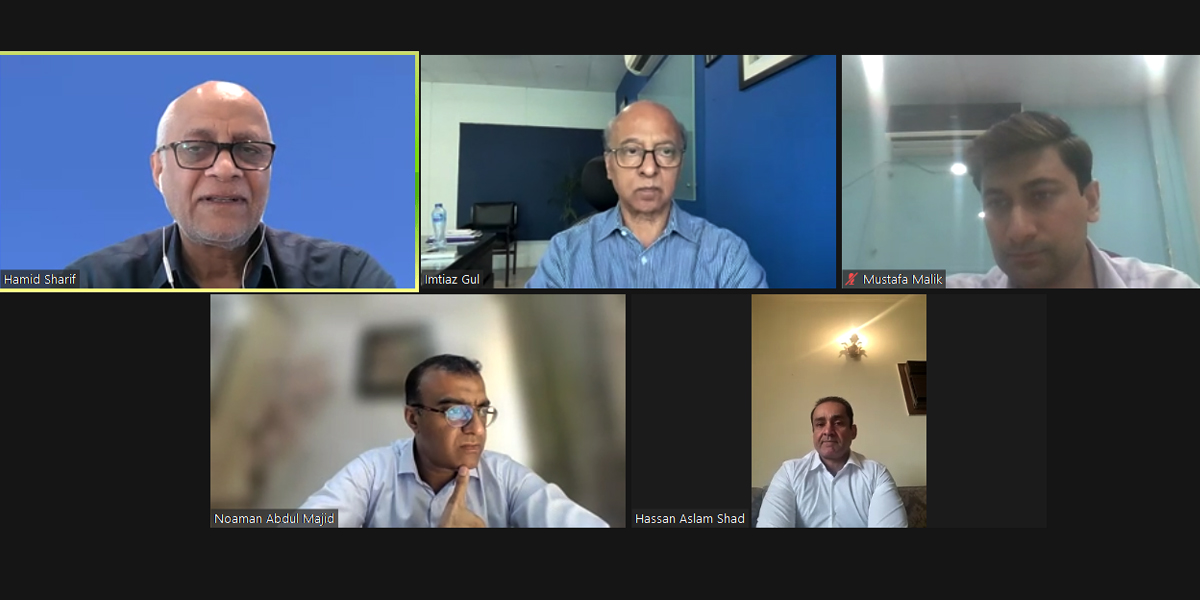

These were the key takeaways from the webinar on “The New Sino-Saudi Strategic Partnership – Opportunities and Challenges for Pakistan”, organized by the Center for Research and Security Studies (CRSS).

Mr. Hamid Sharif, Former Inaugural Managing Director Compliance-Resolution, Evaluation and Integrity at the Asian Infrastructure Investment Bank (AIIB) spoke during the webinar – as the first guest speaker – on the relationship between AIIB and BRI. He noted added that Breton Woods is where the current global finance system originates. It was essentially a Western-led plan, for the restoration of Europe and ignored the demands of the developing countries. However, all of that changed when Emerging Asia began to have a greater voice and impact on the international economic system. In 2008, the President of the World Bank formed a commission, led by the former president of Mexico, to address some of these issues and propose recommendations for governance reforms. One of the key recommendations was to give a greater voice to middle-income countries like China and India. Another was to reduce the number of board members, aiming to address concerns that certain regions, particularly Europe, were overrepresented in the decision-making process.

During 2008-2012, China repeatedly raised concerns and requested that the capital of these institutions be increased to better reflect the changing global economic landscape, and advocated for a redistribution of capital to give middle-income countries like itself more influence and representation. However, nothing productive came out of it, he added.

He then highlighted how as a result of previous failed incentives, in 2013, President Xi proposed BRI and AIIB. The difference between the two is primarily the fact that BRI is an enormous effort in terms of finance, which multilateral development banks like AIIB can hardly fulfill. The major financing of BRI comes from the policy banks of China. However, AIIB is open to financing BRI projects provided they come through a process that multilateral banks follow with due diligence. Another distinctive feature is that, unlike World Bank, every member of AIIB can borrow from the bank in principle, he said.

He emphasized the significance of the Sino-Saudi relationship. For the longest time, AIIB resisted opening offices outside of China, and now their first regional hub is in Abu Dhabi, UAE, which is fully operational. Lessons for Pakistan could be that it can help broker investment from the Middle East to Pakistan, and Saudi Arabia can play a role in leveraging resources into Pakistan, he said.

“AIIB has suspended its operations in Russia post Russia-Ukraine war. So, this means that AIIB is truly functioning as a multilateral institution and is sensitive to all members, not just China. As far as sensible, bankable BRI projects are concerned, AIIB will continue financing them on merit. Also, we speak a lot about the potential in Pakistan but it can only be harnessed by addressing country’s fundamental governance issues. Everyone is doing a temporary job, and there is no custodian for long-term achievement in Pakistan”, said Mr. Hamid while explaining how have investment decisions been affected at the AIIB and along the BRI corridors, in light of the relations between West and China? And what does this mean for financing from the AIIB or Chinese policy banks for Pakistani projects?

“Currently, the biggest concern in international relations is how the countries should handle the U.S.-China emerging competition. The U.S. security documents view China as its most serious strategic challenge, so the other countries have to navigate between the two. On the other hand, China would not like to step in and take over the U.S. security aspect. Similarly, the U.S. realizes that it cannot provide goods like China. China provides a huge energy market for Saudi Arabia and is the largest exporting player in the world. To some extent, the U.S. is fine with the fact that Saudi Arabia and China are developing an economic alliance as long as it does not affect their security aspect”, he noted while discussing how China-Saudi relationship is expected to impact US-Saudi relationship.

The second guest speaker, Mr. Noaman Abdul Majid, Development Finance Advisor, spoke on the institutional mechanism for mobilizing foreign direct investment and explained the rationale behind the China-Saudi partnership. China and Saudi Arabia joining hands together can be termed as the new Middle East. The main difference is that it’s now more geo-economical than geopolitical. Saudi Arabia is mainly focused on the diversification and rebalancing act, he said.

While discussing how Pakistan can gain from this alliance, he stated that it is important to acknowledge the fact that with Pakistan’s financial history, it is now in the 22nd IMF program, which shows Pakistan has been in a permanent financial crisis. Every time there is a difficulty, China, Saudi Arabia or the UAE come to Pakistan’s rescue.

He stated that China and Saudi Arabia are two key strategic partners so Pakistan naturally becomes an ally and partner to them but politically and financially, Pakistan has been unstable for one and a half years, so it hasn’t had any formal part in this relationship. Pakistan can capitalize on investment from this partnership by investing in the human capital development sector. It needs to set up universities and strengthen institutions.

Pakistan has not been able to attract FDI because of lack of institutional mechanism. The board of investors in the country constantly changes. If we look at the public investment fund of Saudi Arabia, it’s in the range of 700 billion dollars and they aspire to be in the range of 3 trillion dollars, and have investments in 50 countries. If Pakistan wants to follow the same path, it needs to adopt the right strategy, resources, and be prepared to attract billion-dollar investments.

“There is an international report of Global FDI Confidence Index by one of the leading consultancies in the world. It lists 20 factors which drive FDI in any country, including technology infrastructure, ease of doing business, regulations etc. If we look at Saudi Arabia, they’ve taken a holistic approach with their vision 2030 report, they have very clear milestones on what they want to achieve. Pakistan has planning and execution problems because our leadership keeps changing. In a span of five years, Pakistan had 10 finance ministers. Pakistan needs consistent leadership for restructuring economic reforms and needs to change its investment climate and get rid of the IMF program. We have to bring down inflation and investment rate, for continuity of economic planning”, he underscored the ease of doing business as a primary prerequisite for FDI and what did Saudi Arabia do in this regard to bring foreign investment.

The third guest speaker, Mr. Hassan Aslam Shad, International Law Expert spoke on the international strategic framework between China & Saudi Arabia and Pakistan’s options. Mr. Hasan started the session by discussing the legal framework, that has been historically applied by both parties and what are the options and opportunities for Pakistan. He noted that the comprehensive strategic partnership between Saudi Arabia and China, was signed in December 2022, with agreements worth $30 billion related to IT, green energy, cloud services, infrastructure, and health.

He stated that China and Saudi Arabia have had a bilateral investment treaty since 1990. Each party is to give the investors of the other party fair and equitable treatment, and there will be no discrimination exercised by one country against the investors from another country. Given the new strategic partnership between China and Kingdom of Saudi Arabia (KSA), this treaty will at some stage come up for revision, which means that they will make it more applicable, and user-friendly for the investors coming into the country. He highlighted that Pakistan and China signed a bilateral investment treaty in 1986. Surprisingly, KSA does not have a bilateral investment treaty with Pakistan, considering it is a close ally of Saudi Arabia. Pakistan should incorporate international best practices and prepare a draft bilateral investment treaty document not only with Saudi Arabia but also revise its treaty with China.

Pakistan can position itself to leverage opportunities if it plays its cards well. He gave the example of the China-Pakistan Economic Corridor (CPEC), a flagship project of the Chinese Belt and Road Initiative, on how Pakistan has managed to do the groundwork in several phases of the CPEC, such as the special economic zones (SEZs). Hence when China and KSA develop their strategic partnership and take it to the next phase, they will require different models in their relationship, one of which could be these special economic zones, giving Pakistan a head start, he added.

Secondly, because of Pakistan’s close ties with China and Saudi Arabia, Pakistan should consider decreasing its energy reliance on Iran. Pakistan should prioritize keeping its two main allies, China and Saudi Arabia pacified, and to Pakistan’s credit, it has carefully navigated the earlier rivalry between Saudi Arabia and Iran. It remained neutral, but now Pakistan will have to demonstrate where its loyalties lie without integrating anyone so that it can enter into investment-related agreements with the KSA.

The executive director of CRSS, Mr. Imtiaz Gul moderated the discussion, and noted that Saudi Arabia was the fastest-growing economy in 2022, with a growth rate of over 8.7%, which indicates significant economic development and diversification in the country. Such rapid growth could be attributed due to various factors, including investments in infrastructure, sports, and entertainment industries.

He also spoke about how the China-Saudi trade has increased over the years. In 2001, the net rate with China was $4.1 billion, whereas, with the West and the U.S., it stood at $38.8 billion. Fast forward to 2021, the net rate with China ballooned to over $87 billion, more than what the U.S. and EU had combined at $78.2 billion with Saudi Arabia, a staggering figure for how China-Saudi trade has quadrupled.

He highlighted that the main agenda of the webinar was to discuss and analyze how Saudi Arabia is transforming, and how the BRI initiative has manifested in increased cooperation between Saudi Arabia and China.